Monzo (the bank of the future). Is it truly digital?

Last week Dan Sheldon shared an article by Jason Bates, co-founder of Monzo, comparing it to my list of things of the internet.

Jason outlined a similar set of ideas to define what he describes as the qualities of ‘truly digital’ propositions. He breaks these down as the follow values or attributes – Real-time, Intelligent, Contextual, Human, Extended and Social (‘Digital R.I.C.H.E.S’).

In recent talks and workshops I’ve been using Monzo as an example of a service that’s beginning to meet the expectations people have in an internet-era of services. Something that we can start to describe as a ‘truly digital’ service.

I signed up to Monzo a few weeks ago thanks to a referral from Craig Abbott. I now have a prepaid debit card which I’m using to track my daily spending on food and drink when at work.

It promises to give me a clearer picture and insight into my spending and transactions as well as helping me instantly send money to other Monzo users. This is useful for splitting payments or sharing small costs (eg. when paying a restaurant bill or paying someone back for the coffee they just bought me). When I signed up it synced my contacts so I’m already connected to many of the ‘digital’ people I know through work.

Monzo’s mission is to ‘build the best current account in the world’. This is vague. As I always ask teams working on the vision for a new service, we need to be clear with what we mean when we say we’re working to make something better or the best. The question is always best compared to what? Or what’s the existing benchmark for good in this industry? – Ryan Thomas Hewitt’s DWP Digital blog post is a good starting point for any ‘benchmarking what good looks like’ conversations.

My long term experience of ‘online’ or digital banking has been pretty average (see my entire Twitter timeline for periodic complaints about HSBC business or personal banking services). The truth is there’s nothing really wrong with HSBC’s online banking experience, it works like analogue banking has always worked but as a virtual experience.

The problem is I now have raised expectations when using digital services. Most online banking still feels like technology built around existing analogue services and processes. I now expect banking technology and services to offer me more than this.

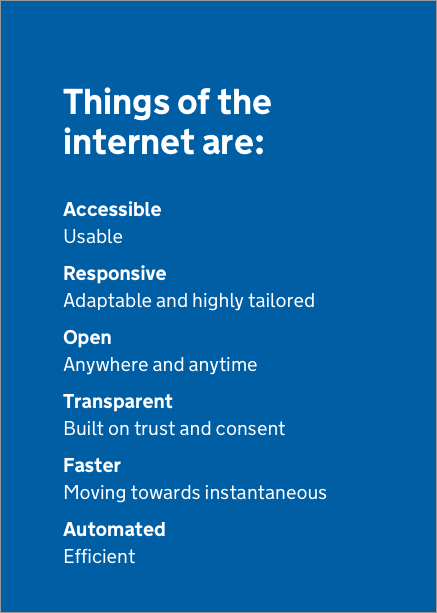

There’s a better breakdown of Monzo’s vision for banking on their homepage. This maps nicely against the ‘of the internet’ list of values and attributes:

Built for your smartphone [Accessible–Usable], this is banking like never before. One that updates your balance instantly [Faster–Moving towards instantaneous/Transparent inc. data driven], sends intelligent notifications [Responsive–highly tailored to individual needs] , and is actually easy to use [again, Accessible/Usable]. We’re building the best current account on the planet and we want you on board [Marketing proposition–they still need to benchmark what good looks like!].

To succeed I believe Monzo will need to find answers to the big challenges of physical banking, moving beyond a virtual or smart phone experience. The question is what a physical banking experience will look like in a digital world. This might not be about physical bank branches on the high street, but banking remains a service that exists to meet the needs of many physical interactions, transactions and exchanges that take place in our everyday lives.

I’m interested to see how using Monzo works in practice and if it changes or shapes how I spend money and make payments. It has the potential to be about more than convenience, helping me with day-to-day saving, spending and financial planning.

First impressions. Monzo is a service that is of the internet and truly digital.

This is my blog where I’ve been writing for 18 years. You can follow all of my posts by subscribing to this RSS feed. You can also find me on Bluesky, less frequently now on X (formally Twitter), and on LinkedIn.